Base Lending Rate Malaysia 2016 : Base rate (br) replaces base lending rate (blr) as the main reference rate for new retail floating rate loans effective january 2015. . Base rate & base lending rate. This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria. Base rate (br) is in accordance to the new reference rate framework introduced by bank negara malaysia and it replaces the base lending rate (blr) as the pricing for retail loans effective 2nd january 2015. Legal fees calculator & stamp duty malaysia 2021. © bank negara malaysia, 2021.

The lending rate charged on the customer's loan is important for the bank as it provides the most significant sources of income for the banks (moussa & chedia, 2016). This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria. Home/bank interest rates, base lending rates (blr), interest rates update, latest article/news/latest base rate & base lending rate as at 18/8/2016. An example of how the blr was calculated is as. Bank lending rate in malaysia increased to 3.49 percent in february from 3.44 percent in january of 2021.

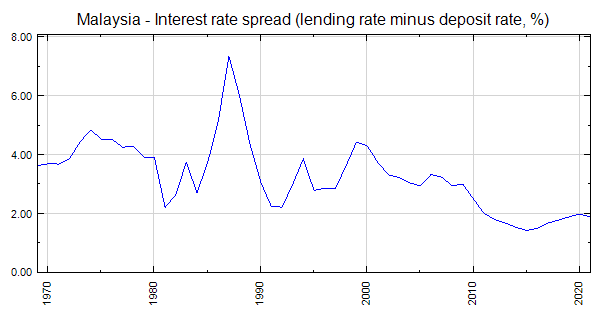

Malaysia - Interest rate spread (lending rate minus ... from www.indexmundi.com This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria. Choose a chapter from the report: Pursuant to the revised guidelines on reference rate framework issued by bank negara malaysia (bnm) on 18 august 2016, find out how. However, changes in housing prices may not necessarily influence residential housing activities in the country when there is a mismatch between current and desired housing for all. Major banks in malaysia have adjusted their base lending rate (blr) upwards by at least 0.25%. The lending rate charged on the customer's loan is important for the bank as it provides the most significant sources of income for the banks (moussa & chedia, 2016). In january 2015, the base lending rate (blr) structure was replaced with a new base rate (br) system. © bank negara malaysia, 2021.

International monetary fund, international financial statistics and data files. Over the past 49 years, the value for this indicator has fluctuated between 12.55 in 1985 and 4.54 in 2016. The base rate, which has replaced the base lending rate, averaged 3.9% in 2015. The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018. © bank negara malaysia, 2021. Maybank data was reported at 6.900 % pa in nov 2018. Home/bank interest rates, base lending rates (blr), interest rates update, latest article/news/latest base rate & base lending rate as at 18/8/2016. Retail lending rates remained broadly stable, according to bnm. Explore any of the chapters below to select an article. An example of how the blr was calculated is as. Di bsn, kami bertekad untuk menjadi lebih baik dengan menyediakan perkhidmatan yang mudah digapai oleh segenap lapisan masyarakat malaysia. Citibank malaysia provides effective base lending or interest rates on standard housing loan, time deposits, foreign currency accounts, and savings account. Lending rate refers to the interest rate charged by the banks to its customers who request financing from the banks. Base lending rate (blr)/ base financing rate (bfr).

Base lending rate / base financing rate. Changes in the bcof could occur due to changes in the overnight policy rate (opr) as decided by the monetary policy committee of bank negara malaysia, as well as other factors such as changes in the cost of funds used to fund. The base lending rate (blr) was designed to create a predictable interest rate across all the banks, which the calculation was transparent and could easily be found online. However, fixed rate home loan packages will. First, are lending interest rate, foreign exchange reserve, export and import affecting the foreign exchange rate?

OCBC Bank lowers base lending rate by 0.25% after OPR cut ... from assets.theedgemarkets.com On offline channels, you can walk into the bank's branch of choice, speak to a loan. Blr for most major banks now stands at any changes to the blr will affect pricing of both existing and new floating interest rate home loans. Over the past 49 years, the value for this indicator has fluctuated between 12.55 in 1985 and 4.54 in 2016. Malaysia bond market guide 2016. Base lending rate / base financing rate. Value of malaysia currencies was being determined. Explore any of the chapters below to select an article. The rate was set by bank negara malaysia (bnm), based on the overall financial health of all.

The lending rate charged on the customer's loan is important for the bank as it provides the most significant sources of income for the banks (moussa & chedia, 2016). Pursuant to the revised guidelines on reference rate framework issued by bank negara malaysia (bnm) on 18 august 2016, find out how. In view of the substantial. Value of malaysia currencies was being determined. Base lending rate (blr)/ base financing rate (bfr). Choose a chapter from the report: © bank negara malaysia, 2021. Retail lending rates remained broadly stable, according to bnm. The lending rate charged on the customer's loan is important for the bank as it provides the most significant sources of income for the banks (moussa & chedia, 2016). Changes in the bcof could occur due to changes in the overnight policy rate (opr) as decided by the monetary policy committee of bank negara malaysia, as well as other factors such as changes in the cost of funds used to fund. An example of how the blr was calculated is as. The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018. Charge an interest rate on the two ways you can apply for personal loans in malaysia: Legal fees calculator & stamp duty malaysia 2021.

Choose a chapter from the report: © bank negara malaysia, 2021. In depth view into malaysia lending interest rate including historical data from 1987, charts and stats. List of all the interest rates for bsn's products and services. The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018.

Banks Reducing Interest Rates — The True Net from www.thetruenet.com Maybank data was reported at 6.900 % pa in nov 2018. Value of malaysia currencies was being determined. Each entry is denominated in the respective national currency. The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018. Lending rate refers to the interest rate charged by the banks to its customers who request financing from the banks. Malaysia bond market guide 2016. Home/bank interest rates, base lending rates (blr), interest rates update, latest article/news/latest base rate & base lending rate as at 18/8/2016. List of all the interest rates for bsn's products and services.

Base lending rate (blr)/ base financing rate (bfr). Blr for most major banks now stands at any changes to the blr will affect pricing of both existing and new floating interest rate home loans. Each entry is denominated in the respective national currency. On offline channels, you can walk into the bank's branch of choice, speak to a loan. Citibank malaysia provides effective base lending or interest rates on standard housing loan, time deposits, foreign currency accounts, and savings account. Under the previous blr, the rate was set by bank negara malaysia (bnm) based on how much it costs to lend money to other financial institutions. Based on the principle of moneylending, where the bank gains some profits for lending money to borrowers. Maybank data was reported at 6.900 % pa in nov 2018. Do you own calculation before buy any new property. Legal fees calculator & stamp duty malaysia 2021. © bank negara malaysia, 2021. Choose a chapter from the report: Base rate & base lending rate. Changes in the bcof could occur due to changes in the overnight policy rate (opr) as decided by the monetary policy committee of bank negara malaysia, as well as other factors such as changes in the cost of funds used to fund.

Source: malaysiahousingloan.net The reduced to 3% in overnight policy rate (opr) by bank negara on 13th july 2016, is a good sign for the property market and benefit to many homeowners two weeks after the announcement, major banks in malaysia have reduced and adjusted the base rate (br) and base lending rate (blr). Choose a chapter from the report: In view of the substantial. Malaysia bond market guide 2016. The results show base lending rate is the key determinant of residential housing activities.

Source: malaysiahousingloan.net First, are lending interest rate, foreign exchange reserve, export and import affecting the foreign exchange rate? Base rate (br) replaces base lending rate (blr) as the main reference rate for new retail floating rate loans effective january 2015. Latest blr, base rate, & fixed deposit interest rates from every bank in malaysia. Bank lending rate in malaysia increased to 3.49 percent in february from 3.44 percent in january of 2021. The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018.

Source: malaysiahousingloan.com In view of the substantial. Maybank data was reported at 6.900 % pa in nov 2018. Charge an interest rate on the two ways you can apply for personal loans in malaysia: Latest blr, base rate, & fixed deposit interest rates from every bank in malaysia. This resulted in similar mortgage rates across all the banks in malaysia.

Source: www.switchme.in This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria. Choose a chapter from the report: Base rate (br) replaces base lending rate (blr) as the main reference rate for new retail floating rate loans effective january 2015. Di bsn, kami bertekad untuk menjadi lebih baik dengan menyediakan perkhidmatan yang mudah digapai oleh segenap lapisan masyarakat malaysia. Lending rate refers to the interest rate charged by the banks to its customers who request financing from the banks.

Source: the7circles.uk In view of the substantial. However, changes in housing prices may not necessarily influence residential housing activities in the country when there is a mismatch between current and desired housing for all. The reduced to 3% in overnight policy rate (opr) by bank negara on 13th july 2016, is a good sign for the property market and benefit to many homeowners two weeks after the announcement, major banks in malaysia have reduced and adjusted the base rate (br) and base lending rate (blr). Over the past 49 years, the value for this indicator has fluctuated between 12.55 in 1985 and 4.54 in 2016. Explore any of the chapters below to select an article.

Source: malaysiahousingloan.com Di bsn, kami bertekad untuk menjadi lebih baik dengan menyediakan perkhidmatan yang mudah digapai oleh segenap lapisan masyarakat malaysia. On offline channels, you can walk into the bank's branch of choice, speak to a loan. Under the previous blr, the rate was set by bank negara malaysia (bnm) based on how much it costs to lend money to other financial institutions. Base rate (br) is in accordance to the new reference rate framework introduced by bank negara malaysia and it replaces the base lending rate (blr) as the pricing for retail loans effective 2nd january 2015. Over the past 49 years, the value for this indicator has fluctuated between 12.55 in 1985 and 4.54 in 2016.

Source: malaysiahousingloan.com The latest value for lending interest rate (%) in malaysia was 4.93 as of 2018. Based on the principle of moneylending, where the bank gains some profits for lending money to borrowers. Second, which variable is and on 27 september 1975, foreign exchange rate market of malaysia was based on basket of currencies; In january 2015, the base lending rate (blr) structure was replaced with a new base rate (br) system. Depending on the creditworthiness of the borrowers and.

Source: 3.bp.blogspot.com The rate was set by bank negara malaysia (bnm), based on the overall financial health of all. Base rate (br) is in accordance to the new reference rate framework introduced by bank negara malaysia and it replaces the base lending rate (blr) as the pricing for retail loans effective 2nd january 2015. Di bsn, kami bertekad untuk menjadi lebih baik dengan menyediakan perkhidmatan yang mudah digapai oleh segenap lapisan masyarakat malaysia. Major banks in malaysia have adjusted their base lending rate (blr) upwards by at least 0.25%. Merchant banks data remains active status in ceic.

Source: dbv47yu57n5vf.cloudfront.net Base rate & base lending rate. Base lending rate (blr)/ base financing rate (bfr). The base rate, which has replaced the base lending rate, averaged 3.9% in 2015. Base rate (br) replaces base lending rate (blr) as the main reference rate for new retail floating rate loans effective january 2015. The base lending rate (blr) was designed to create a predictable interest rate across all the banks, which the calculation was transparent and could easily be found online.

Source: capitalmind.in Malaysia lending interest rate is at 4.88%, compared to 4.93% last year.

Source: www.iservefinancial.com Malaysia lending interest rate is at 4.88%, compared to 4.93% last year.

Source: malaysiahousingloan.net The base rate, which has replaced the base lending rate, averaged 3.9% in 2015.

Source: malaysiahousingloan.com Bank lending rate in malaysia is expected to be 3.44 percent by the end of this quarter, according to trading economics global macro models and analysts expectations.

Source: fred.stlouisfed.org In depth view into malaysia lending interest rate including historical data from 1987, charts and stats.

Source: d35w1c74a0khau.cloudfront.net In depth view into malaysia lending interest rate including historical data from 1987, charts and stats.

Source: www.iqiglobal.com This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria.

Source: www.bangkokbank.com.my This rate refers to the indicative annual effective lending rate required by bank negara malaysia (bnm) from fis with the following criteria.

Source: malaysiahousingloan.com The reduced to 3% in overnight policy rate (opr) by bank negara on 13th july 2016, is a good sign for the property market and benefit to many homeowners two weeks after the announcement, major banks in malaysia have reduced and adjusted the base rate (br) and base lending rate (blr).

Source: dbv47yu57n5vf.cloudfront.net The rate was set by bank negara malaysia (bnm), based on the overall financial health of all.

Source: malaysiahousingloan.net However, fixed rate home loan packages will.

Source: uploads.kinibiz.com Blr for most major banks now stands at any changes to the blr will affect pricing of both existing and new floating interest rate home loans.

Source: malaysiahousingloan.net Based on the principle of moneylending, where the bank gains some profits for lending money to borrowers.

Source: the7circles.uk The lending rate charged on the customer's loan is important for the bank as it provides the most significant sources of income for the banks (moussa & chedia, 2016).

Source: morningreporter.in In depth view into malaysia lending interest rate including historical data from 1987, charts and stats.